News & Insights

Industry:

Starting a business? How expenses will be treated on your return

Government officials saw a large increase in the number of new businesses launched during the COVID-19 pandemic. And the U.S. Census Bureau reports that business applications are still increasing slightly (up 0.4% from April 2023 to May 2023). The Bureau measures this by tracking the number of businesses applying for Employer Identification Numbers.

Starting a business? How expenses will be treated on your return

Government officials saw a large increase in the number of new businesses launched during the COVID-19 pandemic. And the U.S. Census Bureau reports that business applications are still increasing slightly (up 0.4% from April 2023 to May 2023). The Bureau measures this by tracking the number of businesses applying for Employer Identification Numbers.

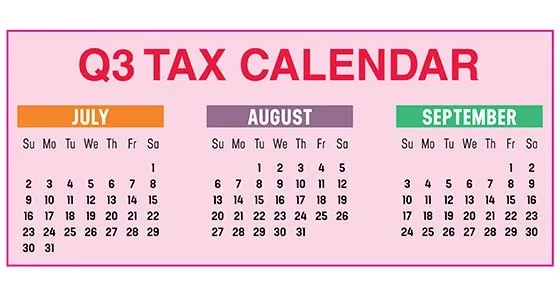

2023 Q3 tax calendar: Key deadlines to consider

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Overcoming benchmark resistance in your nonprofit

If your not-for-profit sets performance goals — and most organizations should — then you need benchmarks to measure your performance. Staffers and your board may not enthusiastically embrace benchmarking at first. But if you can show its value and make the process easy, you should be able to get everyone on board.

Claiming big first-year real estate depreciation deductions

Your business may be able to claim big first-year depreciation tax deductions for eligible real estate expenditures rather than depreciate them over several years. But should you? It’s not as simple as it may seem.

IRS has just announced 2024 amounts for Health Savings Accounts

The IRS recently released guidance providing the 2024 inflation-adjusted amounts for Health Savings Accounts (HSAs).

Grant Funding & the Benefit of Single Audits – Part I

While the receipt of these funds helps organizations meet the needs of the community and reach their missions/goals, there are a number of other requirements that organizations may face.

Nonprofits: 4 signs that something may be awry

Many not-for-profit leaders are nervously watching macroeconomic signs — inflation, rising interest rates, and the possibility of recession — to predict how their organization will fare in the coming months and years.

New-and-improved accounting rules for common control leases

On March 27, 2023, the Financial Accounting Standards Board (FASB) published narrowly drawn amendments to the lease accounting rules.

Why nonprofits need to track staffers’ time

Not-for-profit organizations are compelled by federal and state wage-and-hours laws to perform a certain amount of time tracking. Funders may also stipulate timekeeping practices.

Retirement saving options for your small business: Keep it simple

If you’re thinking about setting up a retirement plan for yourself and your employees, but you’re worried about the financial commitment and administrative burdens involved, there are a couple of options to consider.

Nonprofits: 4 ratios worth watching

To control your not-for-profit’s expenses and improve operating efficiency, you need to keep an eye on the numbers. This should come as no surprise.

No results found.