News & Insights

Industry:

New Voluntary Disclosure Program for Employers that Filed Dubious ERC Claims

As part of its continuing fight against questionable Employee Retention Credit (ERC) claims, the IRS recently announced a Voluntary Disclosure Program for employers. Under the program, businesses can "pay back the money they received after filing ERC claims in error," the IRS explains.

The standard business mileage rate will be going up slightly in 2024

The price of gas is about the same as it was a year ago. Will this affect the amount your business can deduct for business driving in 2024?

New per diem business travel rates kicked in on October 1

Taxpayers can use these rates to substantiate the amount of expenses for lodging, meals, and incidentals when traveling away from home. (Taxpayers in the transportation industry can use a special transportation industry rate.)

Social Security wage base is increasing in 2024

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $168,600 for 2024 (up from $160,200 for 2023). Wages and self-employment income above this threshold aren’t subject to Social Security tax.

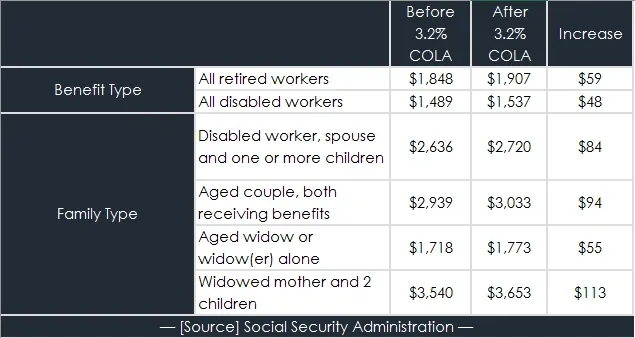

Social Security announces cost-of-living adjustment for 2024

Monthly Social Security and Supplemental Security Income (SSI) benefits for more than 71 million Americans will increase 3.2% in 2024, the federal government just announced.

4 ways to prepare for next year’s audit

Every fall, CPAs are busy preparing for audit season, which generally runs from January to April each year. This includes meeting with clients, assigning staff, and scheduling fieldwork.

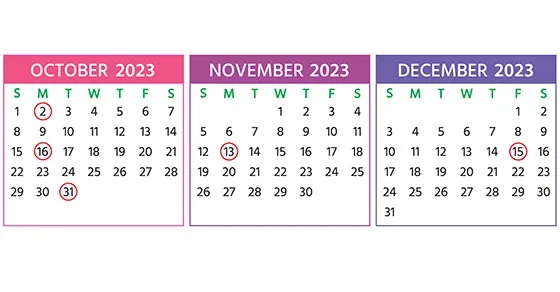

2023 Q4 tax calendar: Key deadlines for businesses

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

IRS Orders an Immediate Stop to New ERTC Processing

After receiving a deluge of improper Employee Retention Tax Credit (ERTC) claims, the IRS recently announced an immediate moratorium through at least December 31 on processing new claims for the pandemic relief program.

The Basics of the ERTC

When properly claimed, the Employee Retention Tax Credit (ERTC) is a refundable tax credit designed for businesses that continued paying employees during the COVID-19 pandemic. The complex credit isn't available to individuals.

Update on depreciating business assets

The Tax Cuts and Jobs Act liberalized the rules for depreciating business assets. However, the amounts change every year due to inflation adjustments. And due to high inflation, the adjustments for 2023 were big. Here are the numbers that small business owners need to know.

Grant Funding & the Benefit of Single Audits – Part II

Austin has a growing population of non-profit organizations that receive grant funds, which can be federal or state-sourced and can come in many different sources: Grants, Loans, usages of land, and food / other commodities.

Nonprofits: Special events call for tax planning

Does your business receive large amounts of cash or cash equivalents? If so, you’re generally required to report these transactions to the IRS — and not just on your tax return.

No results found.